Bitcoin and Tariffs: How to Position for What Comes Next

Institutional Crypto Research Written by Experts

If you no longer wish to receive our crypto market updates, you can easily unsubscribe at the bottom of this page.

Topics covered: bitcoin, tariffs, on-chain, altcoins, trend, Fed, ISMViews: short-term, medium term, trading strategy/expectation around tariffs for bitcoin👇1-16) Several key trends are unfolding in the cryptocurrency markets, and it’s important to clarify them. While we frequently provide updates, we want to be more explicit about whether our reports are short-term (1–4 weeks) or medium-term (1–6 months) in focus. Generally, on-chain data tends to support medium-term outlooks, whereas reversal indicators and tactical setups are typically short-term in nature. Some subscribers prefer medium-term outlooks and broader market perspectives, while others are more focused on our day-to-day trading insights and short-term analysis.

Bitcoin expected to outperform Altcoins based on our model

👇2-16) The longer the time horizon, the less emphasis we place on stop-losses, as the upside potential can absorb short-term volatility. However, if we identify a short-term bullish setup within a medium-term bearish view, tight risk management—or avoiding the trade altogether—is critical. This also requires closely monitoring for shifts in market narrative and watching closely if key stop levels are breached.

👇3-16) In the medium term, we struggle to see meaningful upside, as there are currently no strong growth catalysts. While markets are pricing in a Fed rate cut by June, we believe the Fed may remain on hold until September. Inflation remains elevated, the full impact of U.S. tariffs remains unclear, and the labor market has yet to show signs of significant weakness. Although Powell struck a dovish tone in mid-March and quantitative tightening is being scaled back, it may be too early for concrete easing measures. Bitcoin, in our view, is looking for real action—not just dovish talk.

👇4-16) It's critical to trade with the trend in crypto rather than trying to catch a bottom—low prices can always go lower. An asset trading at $0.001 can still fall another 90%. Bitcoin remains below our trend model, which has now declined to around $88,000 from its original sell signal of $96,000. It also trades below the 21-week (147-day) moving average—a simple yet highly effective indicator for distinguishing between bull and bear markets. This key moving average also sits near $88,000, making long-term positions below that level risky unless supported by strong on-chain data.

Bitcoin Trend Model Signal - bearish below $87,910 (~$88,000)

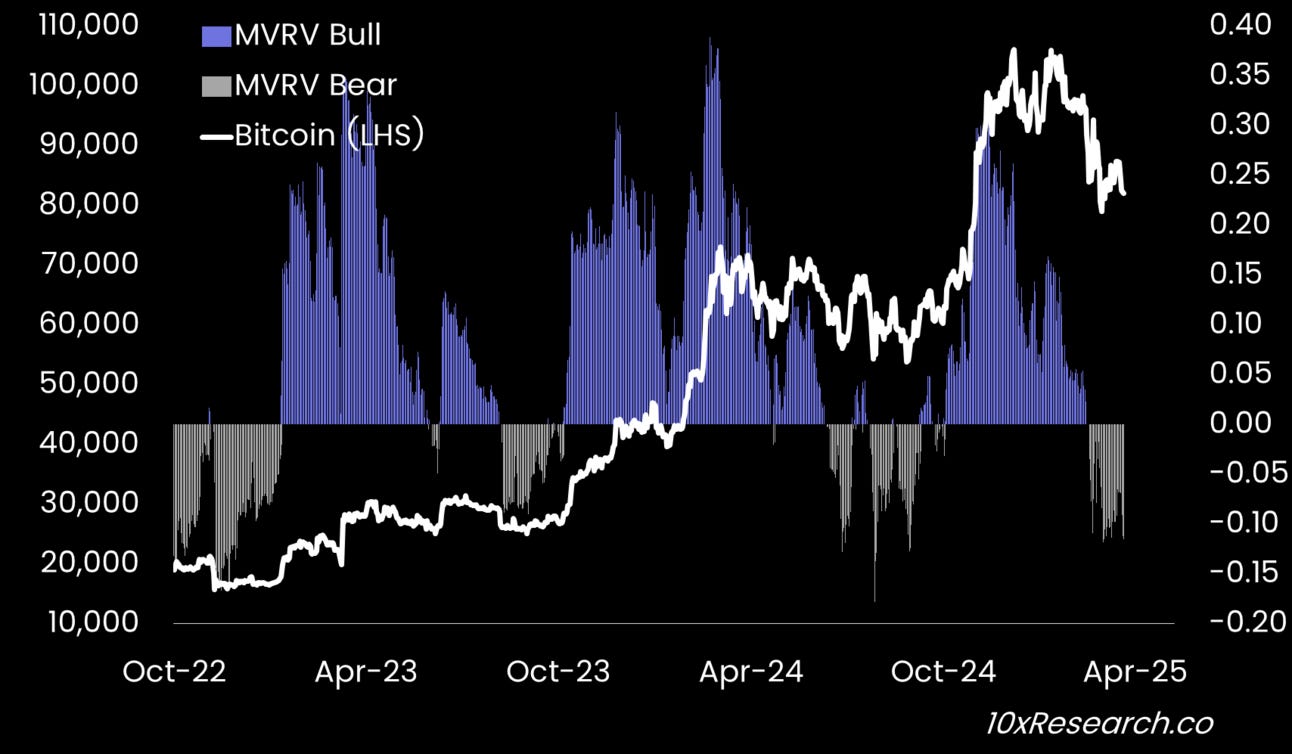

👇5-16) There’s little doubt from on-chain data that Bitcoin is currently in at least a mini-bear market—and unless momentum improves, that remains the base case. While oversold conditions can offer short-term tactical opportunities, sustained upside is unlikely without support from on-chain metrics. One of our most reliable indicators, the short-term holder realized price (currently near $93,000), reflects the average entry point for recent buyers over the past 155 days.

👇6-16) As we warned, once Bitcoin broke below this level, liquidations followed, and the subsequent rally back toward it was met with selling pressure as traders exited breakeven positions—making it a tough resistance to reclaim. All three phases played out: the breakdown, the retest, and the rejection.

👇7-16) The bull market has stalled as Trump has yet to deliver any new, unexpected (crypto-related) developments since his inauguration. The executive order to create a Strategic Bitcoin Reserve lacks weight without congressional approval and could easily be reversed by a future administration. Holding confiscated Bitcoins doesn’t create buying pressure, especially since there has been no clarity on how much Bitcoin will be included. Meanwhile, recent crypto events/summits have failed to spark momentum.

👇8-16) Confidence took a major hit when retail investors lost billions on meme coins—especially the $TRUMP token—after exchanges listed them near the peak, providing exit liquidity for insiders. Retail trading volumes have plunged since, signaling a broader retreat. Without retail participation, altcoins and funding rates suffer. Our proprietary indicator, which combines the total crypto market cap and Bitcoin dominance, suggests continued underperformance of altcoins vs. Bitcoin.

👇9-16) This explains the second straight month of Bitcoin ETF outflows, as hedge funds have exited their arbitrage trades amid persistently low funding rates. Without a meaningful rise in funding rates, it's unlikely that ETF inflows will return to their previous size anytime soon. Crypto markets are caught in a kind of “doom loop,” but two weeks ago, prices were oversold, and signs of relief were on the horizon.

👇10-16) Trump claimed productive talks with global leaders, the EU offered early concessions on tariffs, and his abrupt dismissal of Ukraine’s Zelenskyy hinted that a Russia- Ukraine ceasefire could be near. Trump even bought a Tesla to support the stock, reinforcing the notion that the “Trump put” is still in effect. Combined with Powell’s dovish tone, this created a tactical window to trade for a potential move back toward $90,000; however, Bitcoin reversed at $88,500.

Bitcoin (LHS) vs. MVRV on-chain bull / bear market indicator (RHS)

👇11-16) But Putin didn’t cooperate, marking a setback for Trump. At the same time, U.S. trading partners appear to be aligning in a coordinated opposition, responding collectively as Trump adopts a strategy of announcing high tariffs to negotiate them down over time. As Scott Bessent noted, these negotiations may stretch into June. If Trump announces 10% tariffs (20% probability), Bitcoin could rally by 5%. A 20% tariff (60% probability) may lead to a 4% drop, while a 30% tariff (20% probability) could cause Bitcoin to fall by 6%. This implies an expected move of -3% for Bitcoin on the tariff news, especially if retaliation follows swiftly.

👇12-16) Corporate earnings season is also underway, and many executives have already signaled weak forward guidance, which may continue to weigh on sentiment. This will likely be echoed in tonight’s ISM Manufacturing Index, with the new orders component already signaling that the recent restocking phase has ended. Meanwhile, Friday’s labor market data may still appear strong (140k)—making it harder for the Fed to justify rate cuts.

👇13-16) The current market structure remains weak, with low volumes, subdued funding rates, and muted on-chain activity, all indicating that Bitcoin is in a mini bear market. Inflows have dried up, both from stablecoin ramps and Bitcoin ETFs, and medium-term technical indicators won’t turn constructive unless Bitcoin breaks above $88,000.

👇14-16) Without a dovish shift from the Fed or a new bullish narrative, such as those seen in February and November 2024, it’s hard to envision a sustained move higher. While liquidity data shows some promise, its predictive power relies on a 13-week lag and has been historically inconsistent. Nonetheless, the analysis still suggests a move higher into June, although short-term volatility is to be expected—even if the indicator ultimately proves inaccurate.

👇15-16) The negative funding rate has a strong track record of forecasting higher prices over a three-month horizon—but short-term volatility remains very likely. This is likely to keep Bitcoin range-bound between $73,000 and $94,000 in the near term (1-4 weeks). As a trading strategy, we would consider selling puts during any initial downside move to benefit from elevated volatility or selling calls if Bitcoin rallies toward the upper end of the range.

👇16-16) However, Bitcoin is showing resilience, holding up better than its typical beta with equities would suggest and hovering just below the key $88,000 level. Our highest conviction remains that altcoins will continue to underperform, while Bitcoin is likely to stay range-bound in the near term. Without a clear macro catalyst, downside risk persists—but notably, over the past week, TRX (Tron) and TON (Toncoin) have outperformed, despite the broader market weakness. Their relative strength may reflect a unique positioning that benefits them—directly or indirectly—from rising geopolitical and trade tensions, potentially making them short-term hedges within the crypto space.