Bitcoin Bottom Forming? Fed Eases, Trump Softens Tariffs, Altcoins Break Out?

Institutional Crypto Research Written by Experts

👇1-13) We anticipated a deeper correction after Bitcoin broke below $95,000, confirming the breakdown from its ascending broadening wedge. However, over the past week, we’ve adopted a more constructive outlook as increasing technical indicators have begun aligning with a potential recovery.

👇2-13) As we highlighted in our March 15 report, Bitcoin is attempting to form a bottom, supported by Trump’s recent shift toward “flexibility” on the upcoming April 2 reciprocal tariffs, softening his earlier rhetoric. Our March 17 report also noted a mildly more constructive outlook following a CPI release that helped ease inflation concerns. The FOMC meeting unfolded in line with our expectations, as the Fed signaled it might look past short-term inflationary pressures, laying the groundwork for potential future easing—precisely as we had anticipated.

Bitcoin - bottoming formations

👇3-13) Since our March 17 report, “HYPE Reloaded: Is the Dip a New Entry Point?”, Hyperliquid’s HYPE token has climbed +21%, proving that selective opportunities still exist despite overall trading volumes slipping into a typical summer lull as the market awaits its next catalyst. This mirrors the sentiment we observed in September 2024, when traders grew indifferent, but our models correctly identified an impending breakout by closely tracking market dynamics.

HYPE is already +21% in just a few days… some altcoins are attractive

👇4-13) When managing capital for Millennium and other hedge funds, we always allocated part of the portfolio to systematic strategies, as disciplined, model-driven processes consistently alerted us to trend shifts. Even in quieter markets like today, such an approach helps uncover early signals, and we see several emerging developments that could act as meaningful catalysts in the coming months.

👇5-13) As quarter-end approaches, multi-asset funds will likely rebalance their bond and equity allocations. Given bonds’ strong outperformance, this could prompt a rotation out of bonds and into equities, providing support for risk assets. Additionally, we expect Bitcoin ETF selling from arbitrage-focused investors to wind down, as the arbitrage opportunities have primarily been closed for weeks. Quarter-end rebalancing typically brings elevated trading volumes, creating a natural window for these investors to unwind their remaining positions fully.

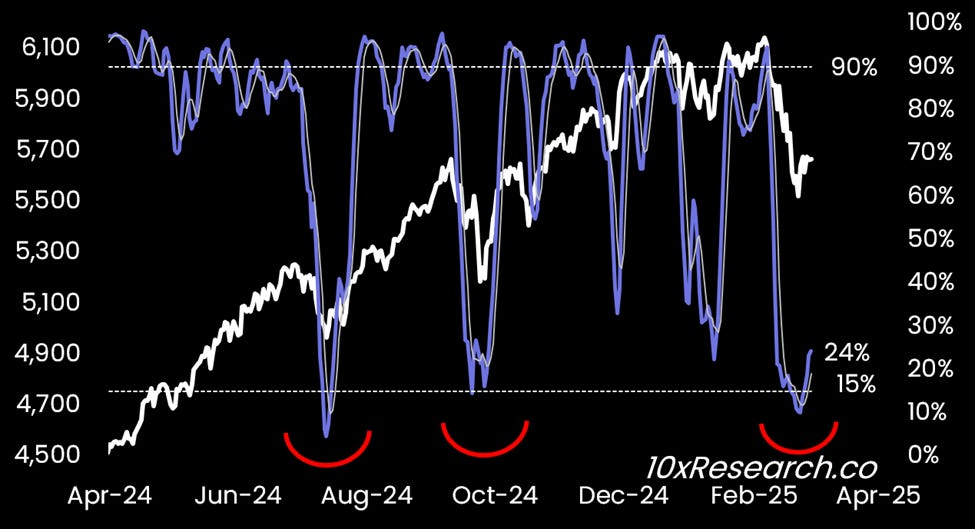

SP500 - putting in a major bottom?

👇6-13) Technical indicators for the S&P 500 point to a potential tradeable bottom, with risk-reward now favoring the upside. Although concerns around corporate earnings persist, much of the tariff risk has already been priced in. With equities down 10% despite no clear recession signals, this correction may mark a meaningful reset. Additionally, Powell’s mildly dovish tone suggests that the Fed's put remains intact, providing further support for a recovery in stock prices.

👇7-13) Our three Bitcoin reversal indicators have turned bullish, with price action approaching the 21-day moving average at $85,200. A break above $90,000 would trigger a bullish signal from our trend model, but this level is still a significant resistance level. Interestingly, the weekly reversal indicators have pulled back to levels where past bull markets have typically resumed, such as during the consolidation phases of September 2023 (ahead of the Bitcoin ETF narrative) and August 2024 (before the Trump election rally). In short, the technical backdrop has now reset to a point where a renewed uptrend could plausibly unfold.

👇8-13) No clear catalyst exists for an immediate parabolic rally; the risk-reward dynamic is shifting as selling pressure fades—something easily overlooked without closely monitoring daily developments. Bitcoin ETF inflows resumed last week following a $10 billion drop in open interest in BTC CME futures since the December FOMC meeting. With funding rates hovering near zero, these ETF inflows likely represent long-only capital that tends to be more stable.

BTC ETF and BTC CME Open Interest (LHS, $ billions) vs. Bitcoin (RHS)

👇9-13) We previously identified that the largest Bitcoin holders are wallets containing 100 to 1,000 BTC (valued between $8 million and $80 million), likely representing family offices and wealth managers. These investors typically use Bitcoin as a diversification tool and are less likely to engage in short-term selling. This insight was key to our view that Bitcoin would avoid a deep bear market, prompting our tactical short call targeting $73,000 – and no further, nearly reached when Bitcoin retraced to $76,000 from the $95,000 support level we flagged.

👇10-13) Hence, as we pointed out a week ago, the outlook has switched to be mildly more constructive and while we identified on February 25 of an ascending broadening wedge that correctly anticipated an initial -10% drop and a rally back towards the $95,000 break level which occurred when Trump claimed a US Strategic Bitcoin Reserve would buy altcoins and then fell off even more, as is typical for ascending broadening wedge patterns break.

👇11-13) Multiple technical signals point to Bitcoin forming a broadening bottom, increasing the likelihood of a move back toward the $90,000 level. Powell’s dovish tone, reiterated during the recent FOMC press conference, further signaled the Fed’s intent to support risk assets.

👇12-13) As forecasted last week, Trump has confirmed a more flexible and targeted tariff approach. This will ease downside risks for equities and provide a positive backdrop for Bitcoin and the broader crypto space. As we’ve emphasized several times over the past week, while the momentum may not be strong enough to drive Bitcoin to new all-time highs just yet, actively trading within the current range could still present valuable opportunities.

👇13-13) We are leaning toward tactical and technical reversal signals even though on-chain data, trend models, and market structure still point to a softer environment. However, in our view, the pressure is building to the upside. Our HYPE trade from last week (+21%) might also be an early bullish sign. Several altcoins are already breaking out of their downtrend channels and trading at attractive levels.

Bitcoin - five Elliot Waves correction, broadening bottom pattern