If you no longer wish to receive our crypto market updates, you can easily unsubscribe at the bottom of this page.

Our Week Ahead report is designed to save our subscribers valuable time by summarizing the key developments from the past week while shifting the focus toward what lies ahead. We invest significant effort into curating this information, and our goal is to present it in a format that is clear, actionable, and easy to digest.

Major Crypto Drivers in the Weeks Ahead

👇1-10) Macro: U.S. Inflation Cools to 2.8% as Fed Stays Cautious, Tariffs Loom: The latest US inflation data, released March 17, shows a welcome slowdown, with the annual rate dropping to 2.8% from 3% in January. This cooling trend, driven by softer housing costs and declines in airfares and gas prices, brings inflation closer to the Fed’s 2% target, though core inflation at 3.1% suggests some stickiness remains. This is a positive sign, but tariff impacts could still shake things up. The latest FOMC meeting on March 18-19, 2025, saw the Fed hold rates steady at 4.25%-4.5%, signaling caution amid economic uncertainty. Powell’s comments leaned dovish, emphasizing no rush to cut rates and a belief that tariff-driven inflation won’t derail the bumpy path to 2%.

👇2-10) Policy: SEC nominee Paul Atkins and Comptroller of the Currency nominee Jonathan Gould will testify before the Senate Banking Committee on March 27. The OCC oversees U.S. national banks and is a crucial focus for crypto firms that have long struggled to secure banking access. If the committee advances these nominations, they will move to a full Senate vote for confirmation. The OCC is expected to play a pivotal role in expanding banking access for the digital asset sector and could also serve as the primary regulator for future stablecoin issuers.

👇3-10) Ethereum: Shifts Focus to Hoodi Testnet as Holesky Retirement Confirmed. Ethereum has announced it will retire the Holesky testnet by September, shifting its efforts to the newly launched Hoodi testnet. The move follows Holesky’s recent failure caused by a flawed test of Ethereum’s upcoming Pectra upgrade, which left the network offline and damaged. Despite Holesky being brought back online in March, it continued to suffer from "inactivity leaks" that severely disrupted its validator operations. Entirely removing the exited validators would have taken up to a year. Ethereum’s testnets are critical environments where developers trial upgrades before deploying them on the mainnet. Holesky was primarily designed for Ethereum’s validator ecosystem — stakers and node operators ensuring network security. Hoodi, launched earlier this week, is now set to replace Holesky and will test the Pectra upgrade on March 26. If successful, Pectra could be deployed to Ethereum’s mainnet approximately 30 days later (April 26).

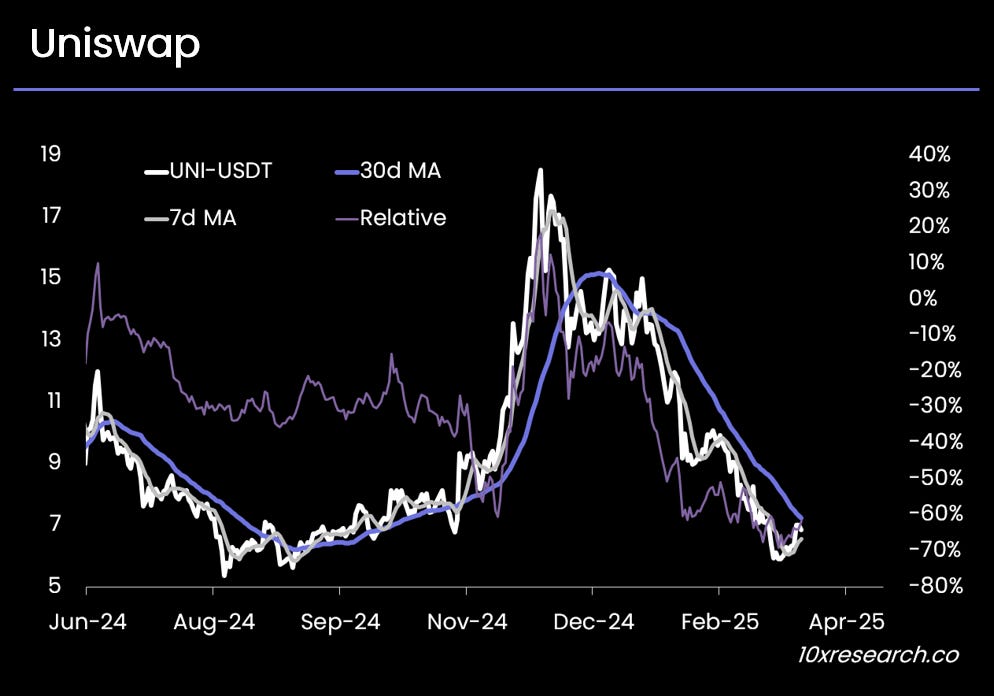

👇4-10) Uniswap: Jumps on $177M Funding Plan, Activate Long-Awaited Fee Switch. Uniswap surged after announcing a $177 million funding initiative to advance its long-anticipated fee switch, boosting investor sentiment. Over 80% of governance participants voted in favor of two key proposals to fund the Uniswap Foundation’s initiatives, potentially laying the foundation for “revenue activation.” The move will distribute nearly 29 million UNI tokens, currently valued at approximately $198 million. This initiative sets the stage for directing protocol revenue—often referred to as the "fee switch"—back to delegators and UNI holders. While fee switch discussions have circulated for years, no proposal has been successfully implemented. Uniswap generated over $1 billion in revenue over the past year alone.

👇5-10) Pump. fun: Launches PumpSwap, Challenging Raydium with Migrations. Pump. fun, a leading Solana-based meme coin launchpad, recently debuted PumpSwap, its own decentralized exchange (DEX), aiming to streamline the trading of tokens created on its platform. Previously, Pump. fun tokens migrated to Raydium once they hit a $100,000 market cap, a process that could take minutes to hours; PumpSwap eliminates this delay with instant migrations and zero migration fees (down from 6 SOL). The DEX introduces a 0.25% trading fee, offers more liquidity, and plans to share revenue with coin creators soon, though no exact date is set. Launched with major tokens like PENGU, USDC, and JUP available for trading, PumpSwap positions itself as a rival to Raydium, which saw its RAY token drop nearly 9% after the announcement. Alongside this, Pump. fun is hosting a $2 million audit competition to ensure security, following nine prior audits and a past $2 million exploit by a disgruntled employee.

👇6-10) Raydium: Unveils LaunchLab to Rival Pump. fun, Adding Bonding Curves. Raydium is launching LaunchLab, its own version of Pump. fun, just weeks after reports surfaced that Pump. fun is building its own AMM. LaunchLab will feature customizable bonding curves—linear, exponential, and logarithmic—that dynamically align token pricing with demand. The platform will also allow third-party UIs to set their own fee structures. Notably, memecoins launched via Pump. fun accounted for 41% of Raydium’s swap fee revenue over the past 30 days. In addition to its unique bonding curves and flexible fee options, LaunchLab will support multiple quote tokens beyond SOL and integrate with Raydium’s liquidity provider locker, enabling issuers to secure swap fees for their tokens indefinitely.

👇7-10) Mantle: Surges After Hardfork Activates EigenDA, 1st Major L2 to Integrate. Mantle (MNT) recently completed a significant mainnet hardfork, activating EigenDA, a data availability solution that enhances network efficiency by offloading transaction data from Ethereum. This upgrade, fully integrated over the past five days, boosts scalability with a reported 15MB/s throughput, allowing more transactions per block and driving a price surge for MNT. The hardfork also aligns Mantle with Ethereum’s Pectra upgrade, improving censorship resistance and security through EigenLayer’s restaking mechanism. As the first major Layer 2 to adopt EigenDA, Mantle’s ecosystem growth and cost reductions have positioned $MNT for notable market performance.

👇8-10) Ethena: And Securitize Launch Converge, EVM Layer-1 Bridging TradFi & DeFi. Ethena Labs, in partnership with Securitize, introduced Converge, a new Ethereum Virtual Machine (EVM)-compatible Layer-1 blockchain designed to bridge traditional finance (TradFi) and decentralized finance (DeFi). Announced on March 17, 2025, Converge aims to serve as a settlement layer for tokenized assets and digital dollars, with Ethena’s USDe and USDtb stablecoins as native gas tokens and ENA for staking to secure the network. It targets retail and institutional users, offering permissionless DeFi access alongside permissioned, KYC-compliant applications for institutions. With a developer testnet soon and a mainnet launch planned for Q2 2025, Ethena intends to migrate its $6 billion DeFi ecosystem, while Securitize will issue its $2 billion in tokenized real-world assets (RWAs). Converge seeks to capitalize on the growing RWA market, supported by partners like Pendle, Aave, and custodians like Fireblocks, positioning it as a hub for institutional-grade DeFi and tokenized finance.

👇9-10) BNB Chain: Activates Pascal Hardfork, Kicking Off 2025 Upgrade Roadmap. The BNB Chain Pascal hardfork, implemented on March 20, 2025, marks a major upgrade to the BNB Smart Chain (BSC), enhancing network performance, security, and Ethereum compatibility in line with BNB Chain’s 2025 roadmap. Inspired by Ethereum’s upcoming Pectra upgrade, the Pascal hardfork was initially tested on the BSC Testnet on February 25, 2025. Key improvements include the integration of EIP-7702, allowing externally owned accounts (EOAs) to temporarily operate as smart contracts, and BEP-439, which introduces the BLS12-381 cryptographic curve for more efficient transaction verification. The upgrade also aligns with Ethereum’s EIP-7685 by adding a "RequestsHash" field to block headers. Pascal is the first in a series of three major upgrades planned for 2025, followed by the Lorentz Hardfork in April (reducing block times to 1.5 seconds) and the Maxwell Hardfork in June (targeting sub-second finality with 0.75-second blocks).

👇10-10) Major token unlocks