Part 1: The 4 Bitcoin Catalysts Everyone Is Watching

Institutional Crypto Research Written by Experts

If you no longer wish to receive our crypto market updates, you can easily unsubscribe at the bottom of this page.

This report is longer than our usual publications, but it tackles many of the key questions surrounding our current outlook. We recommend reading Part 1 today and Part 2 tomorrow for the full picture.

👇1-26) Although we correctly anticipated the decline in Bitcoin, we became more constructive two weeks ago. This shift was driven by Fed Chair Powell’s signal that the Fed remains willing to look through inflationary pressures and still pursue rate cuts—effectively keeping the Fed put alive.

👇2-26) At the same time, the Trump administration hinted at a downside threshold in U.S. equities that would prompt intervention to stabilize markets. Risk assets were also deeply oversold, pointing to a potential rebound.

👇3-26) By mid-March, we expected that most Bitcoin arbitrage positions had been fully unwound, as funding rates remained unattractive for an extended period. The BTC ETF-related selling—one of the main catalysts behind the recent decline—appeared to have largely run its course. As is often the case, markets began recovering ahead of the anticipated April 2 tariff announcement, suggesting that the event had already been factored into prices.

Bitcoin broke the triangle pattern

👇4-26) This was particularly relevant, given that the sharp underperformance of stocks relative to bonds would typically trigger significant quarter-end rebalancing flows from real-money investors, offering at least short-term support.

👇5-26) The VIX index, which gauges implied market volatility, has remained subdued, while high-yield corporate credit spreads have also begun to tighten—both signaling improved market sentiment. Based on this, we expected a tactical Bitcoin rebound from the low $80,000s to slightly above $90,000—though it ultimately peaked at $88,500. However, two key developments have reignited downside risks.

👇6-26) Although the official U.S. corporate earnings season has yet to begin, a handful of companies have already reported—and while they exceeded expectations on both revenue and profit, their cautious outlooks and weak guidance triggered stock sell-offs. This uncertainty may begin to influence consumer behavior through the wealth effect, leading to reduced spending and further pressure on corporate earnings.

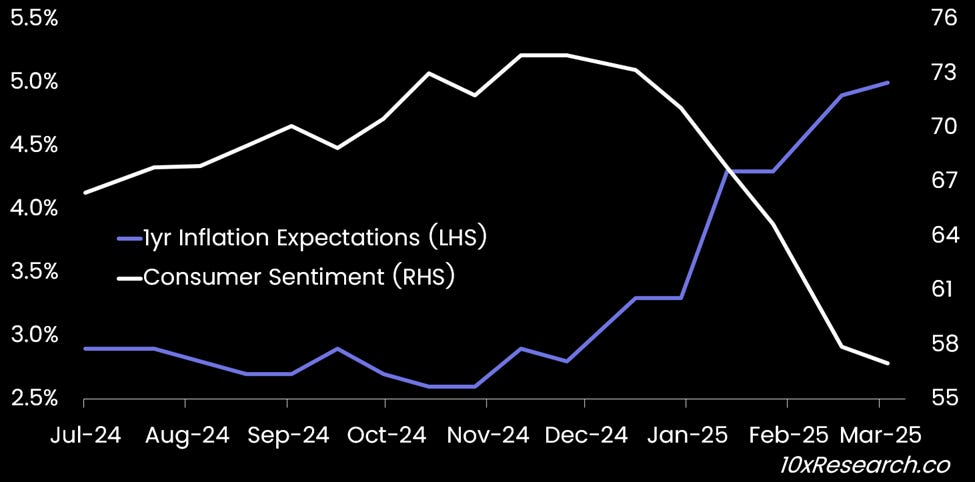

US 1-year Inflation Expectations (LHS) vs. US Consumer Confidence

👇7-26) We're already seeing signs of this in the latest data: Incomes continue to rise, but consumer spending has softened, inflation expectations over the next 12 months have risen to 5.0%, and consumer sentiment has declined, signaling a more fragile economic backdrop.

👇8-26) Another reason behind the recent U.S. stock sell-off, as we previously highlighted, is the sharp downgrade in earnings expectations for the "Magnificent 7" tech stocks. While the tech sector posted strong earnings growth in 2024—22.9% in Q2, 22.7% in Q3, and 23.3% in Q4—estimates for Q1 2025 have been slashed to just 12.7%, reflecting more cautious corporate guidance.

👇9-26) Tesla, for instance, reported its first year-over-year decline in vehicle deliveries. Tesla shares also rebounded after Trump (put) stepped in with a publicity stunt—personally purchasing a Tesla, signaling support for the company.

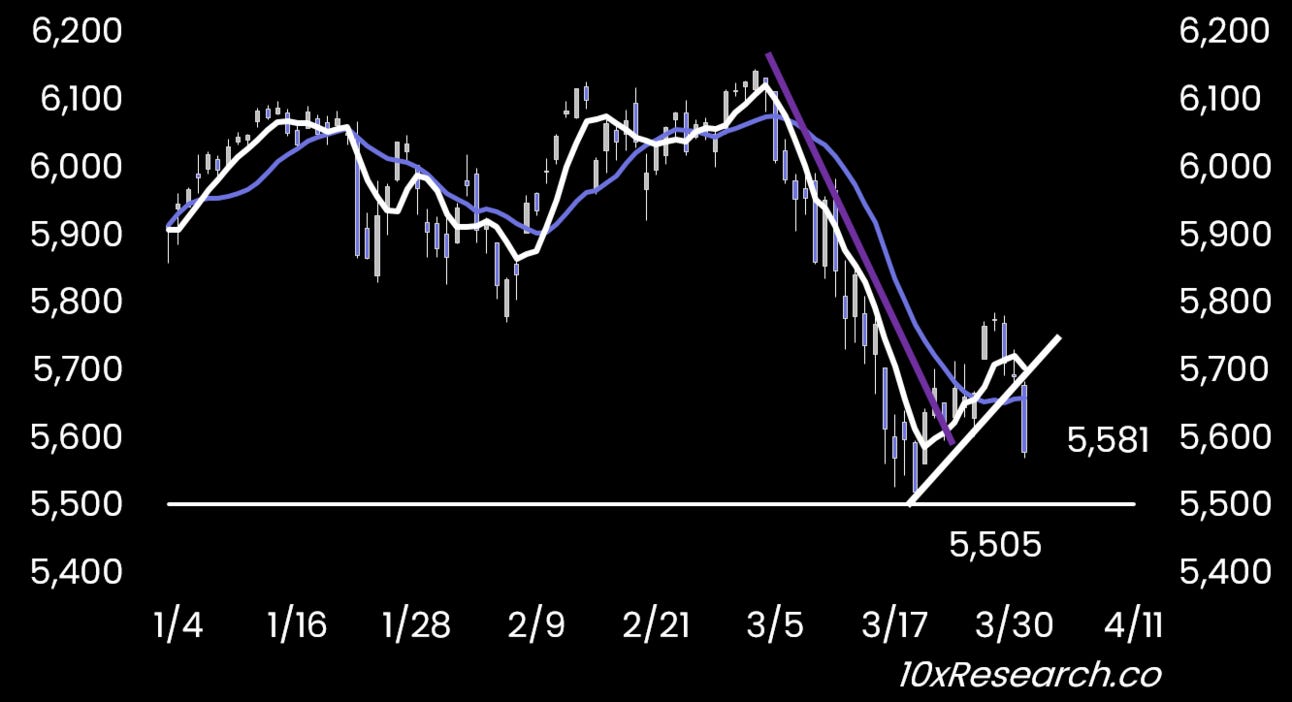

SP500 broke the downtrend, but then broke the mini-uptrend

👇10-26) Meanwhile, hyperscalers are projected to spend $315 billion in 2025, raising concerns about the lack of clarity on how this massive investment will translate into market share gains and profits. NVIDIA, the primary beneficiary of this spending spree, is still trading at the same level as 11 months ago—casting doubt on whether continuous hardware investment has been the right strategy. Amid economic uncertainty, a cutback in capital expenditures by the hyperscalers would come as a major negative surprise and could significantly rattle market expectations.

👇11-26) Unless there is greater clarity on April 2, weak corporate guidance may persist into the upcoming U.S. earnings season, with many companies currently hesitant to hire or commit to capital expenditures. This cautious environment became even more pronounced last week, as Trump unexpectedly implemented a 25% tariff on auto imports on March 26—harsher than many anticipated. So far, Trump’s efforts to negotiate a peace deal between Ukraine and Russia have yielded no tangible results, increasing pressure on him to secure a political win elsewhere—and soon.

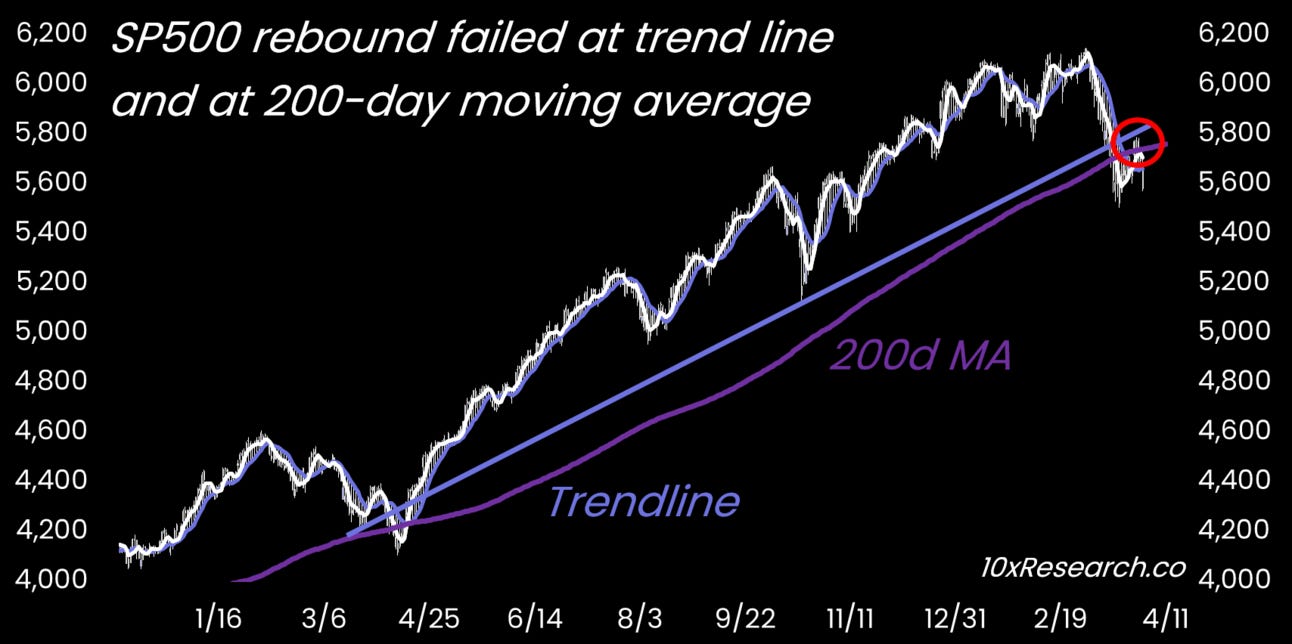

SP500 failed at major uptrend line and at 200 day moving average

👇12-26) As a result, the market narrative has shifted from "buying the dip" to viewing recent lows as potentially just an intermediate bottom. The swift rollout of tariffs effectively removed the perceived policy "put" that followed the 10% correction. Unlike during Trump’s first term, there is now increasing concern that tariffs may be implemented preemptively, with negotiations following only later—potentially delaying resolution.

👇13-26) In light of the recent auto tariff announcements, it appears that the so-called “Trump put” may be set lower than previously signaled. The policy response to economic pain may also prove less predictable this time around, as Trump appears more committed to using tariffs to address the trade deficit. Without the pressure of reelection, he may be willing to push harder and longer than markets initially anticipated.

👇14-26) The corporate earnings season is expected to peak around April 24, coinciding with the end of the stock buyback blackout period, potentially providing renewed support for equities afterward. By that time, we may also have greater clarity on tariffs, and any ongoing negotiations could help stabilize market sentiment. The next FOMC meeting, scheduled for May 7, could spark increased speculation about a rate cut.

Please stay tuned for Part 2, which will be released tomorrow and continues the insights from this report.